cash flow from assets is defined as

Definition of Cash Flow Statement. The excess cash flow may be.

Financial Structure Modeling And Analysis In A Nutshell Fourweekmba Cash Flow Statement Positive Cash Flow Cash Flow

FCF to the firm is Earnings Before Interests and Taxes.

. Assets are fully depreciated when disposed of and no cash flows are associated with the disposals. Forecast is the preferred approach when valuing equities using discounted cash flows. Without a cash flow statement it may be difficult to have an accurate picture of a companys performance.

The cash flow statement is the financial statement that presents the cash inflows and outflows of a business during a given period of time. Assets include all the sources from where there are income and gain like investments collections sales funds etc. It is the companys ability to.

Understanding the cash flow statement which reports operating cash flow investing cash flow and financing cash flow is essential for assessing a companys liquidity flexibility and overall financial performance. Yet it isnt uncommon for those new to finance and accounting to occasionally confuse the two terms. Free cash flows to the firm can be defined by the following formula.

The Cash Flow Statement is one of the Financial Statements that the company issue to portray the companys financial position. These calculate the total amount of money your organization will receive. It includes the value of all cash flows regardless of duration and is an.

Excess cash flow is a term used to describe the income derived from mortgages or other assets backing a bond that is in excess of what is needed to retire the bond. Cash flow from investing activities is an item on the cash flow statement that reports the aggregate change in a companys cash position resulting from any gains or losses from investments in. Assessing the amounts timing and uncertainty of cash flows is one of the most basic objectives of financial reporting.

It is equally as important as the income statement and balance sheet for cash flow analysis. 1 Projections of the Financial Statements 2 Calculating the Free Cash Flow to Firms 3 Calculating the Discount Rate 4 Calculating the Terminal Value Calculating The Terminal Value The terminal value formula helps in estimating the value of a business beyond the explicit forecast period. Free cash flow to the firm.

Cash flow and profit are essential financial metrics in business. Every time the company makes a cash payment toward the credit purchase for example 1000 per month over the span of a year it will show up as a decrease on the cash flow from investing activity line item. Cash flow to creditors minus cash flow to stockholders is equal to cash flow from assets.

Is defined as after-tax operating profit minus the amount of new investment in. Cash flow and profit arent the same things and its critical to understand the difference between them to make key decisions regarding a businesss performance and financial health. Because of that the purchase of fixed assets usually shows up in the cash flow from investing activity section slowly over time.

Cash flow can be defined as the net amount of cash-to-cash equivalents that are carried in and out of business. A True b False. The cash flow statement only deals with actual cash inflow and outflow unlike accrual accounting where entries are recorded when transactions take place rather than actual cash.

Pin On Business Accounting Basics

/AppleCFJune2019-7034d23092e14723b39c1c22f5e170b3.jpg)

Cash Flow From Investing Activities Definition

Cash Flow Statement Definition Example And Complete Guide Fourweekmba

How Are Cash Flow And Free Cash Flow Different

Cash Flow From Assets Definition And Formula Bookstime

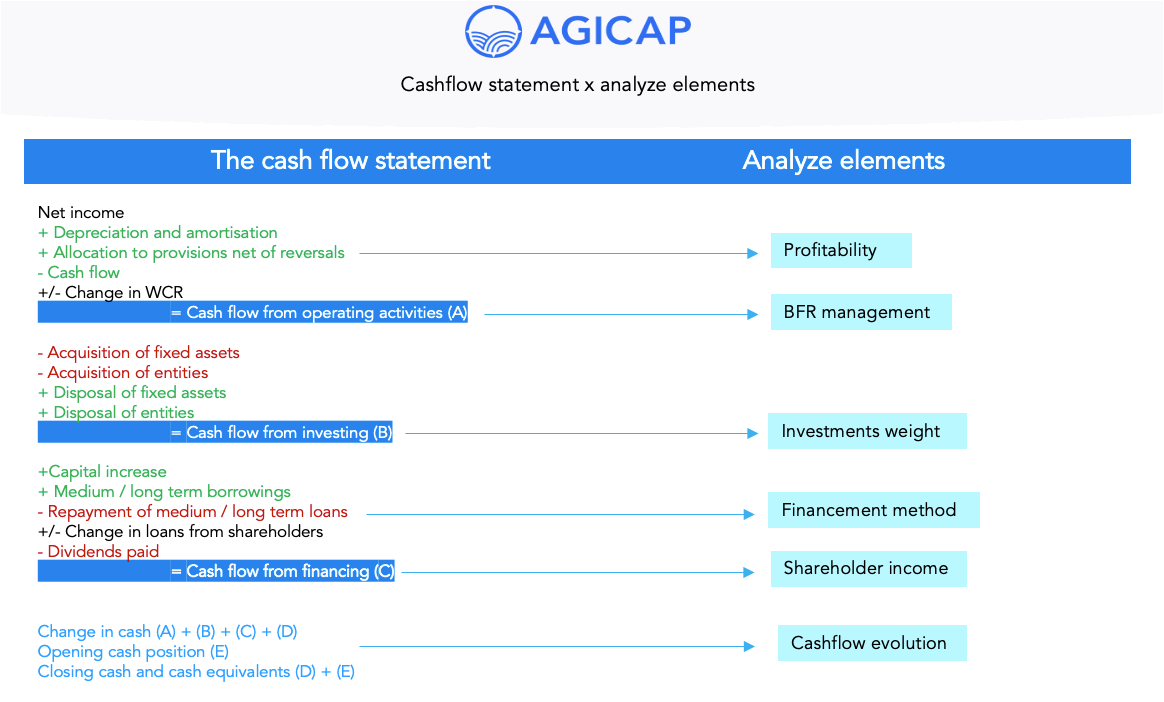

Cash Flow Definition Calculation Translation Agicap

Cash Flow From Operations Ratio Formula Examples

Cash Flow From Assets Definition And Formula Bookstime

How Do Net Income And Operating Cash Flow Differ

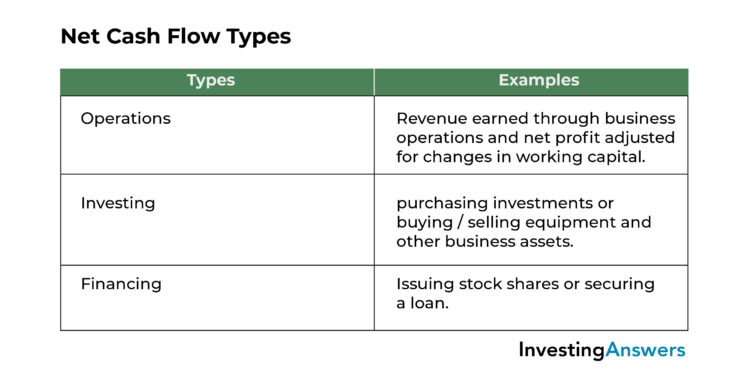

Net Cash Flow Formula Definition Investinganswers

Cash Flow From Assets Definition And Formula Bookstime

Methods For Preparing The Statement Of Cash Flows Cash Flow Cash Flow Statement Accounting Basics

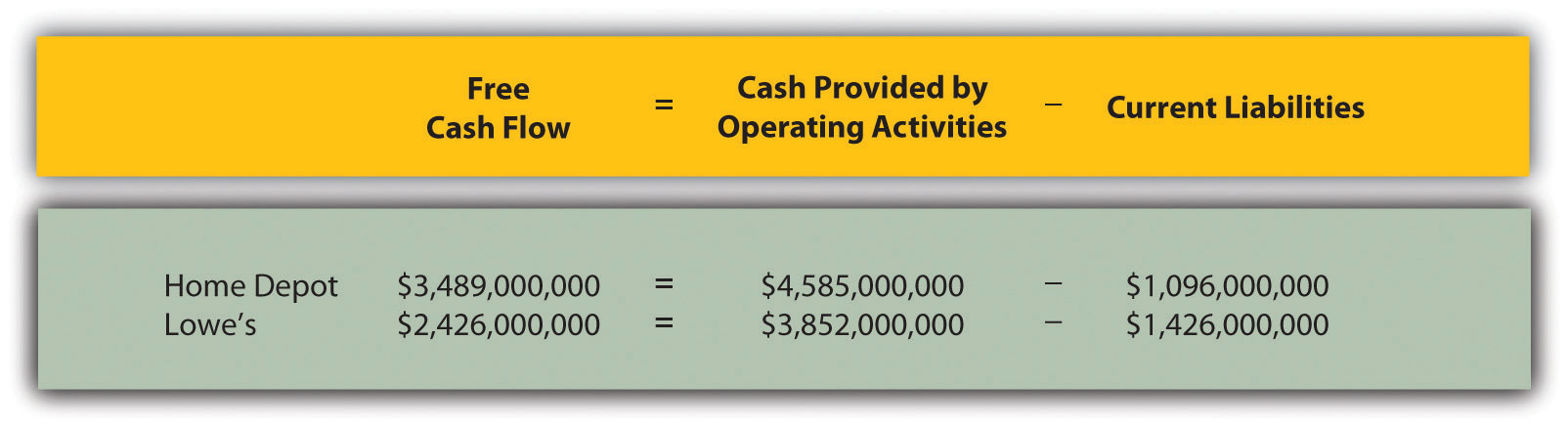

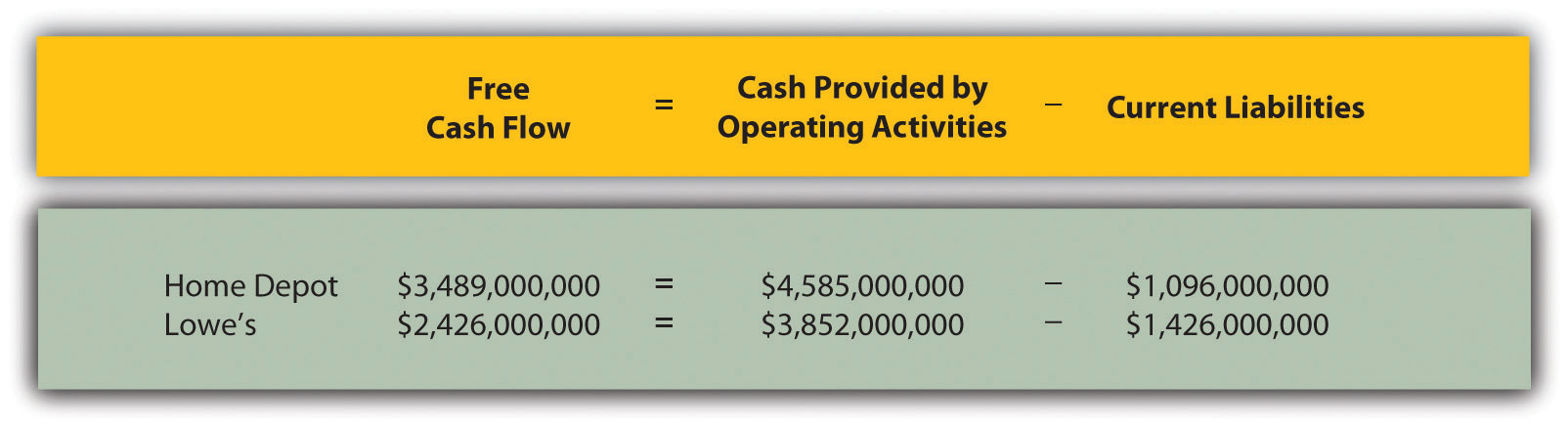

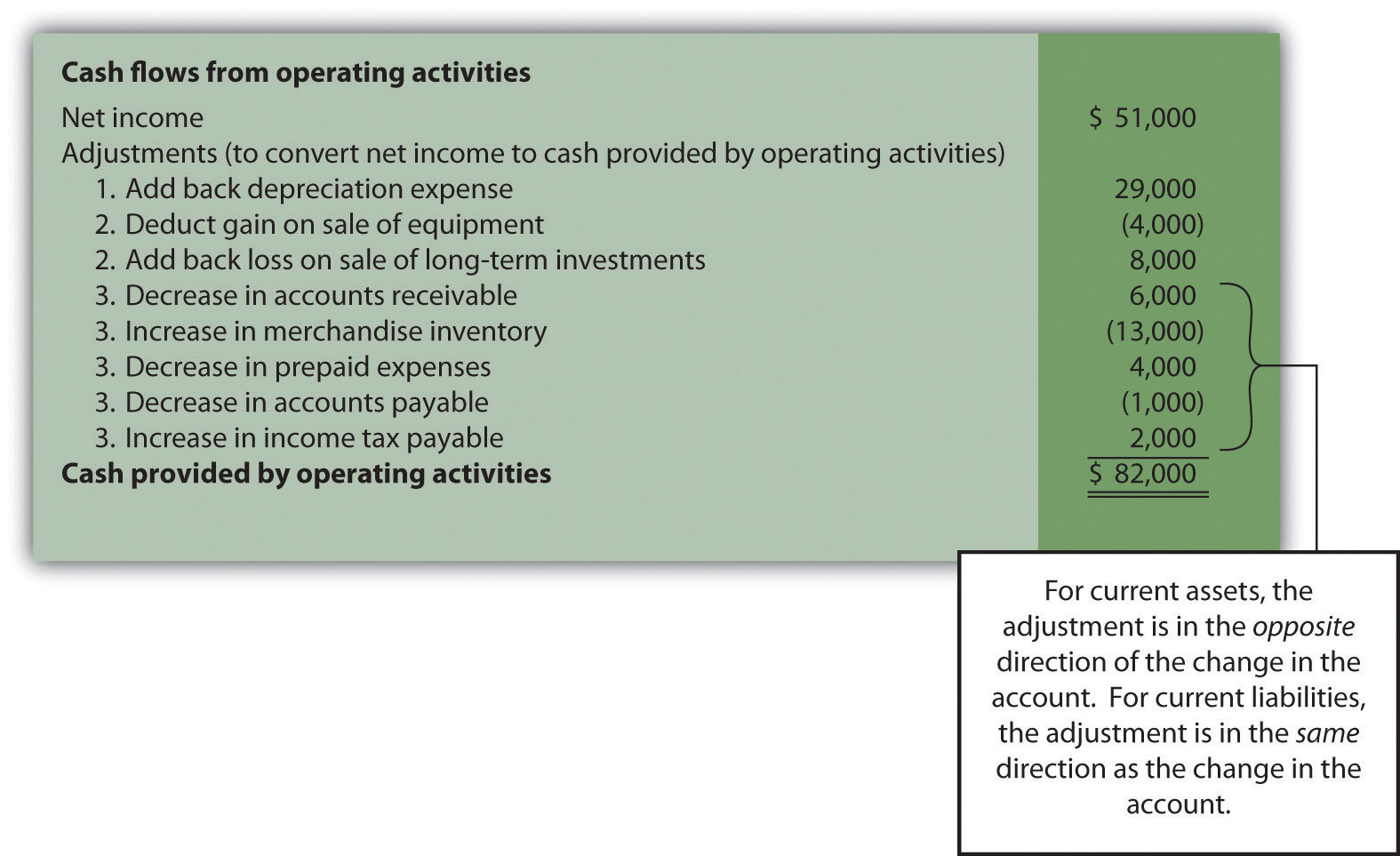

How Is The Statement Of Cash Flows Prepared And Used

How Is The Statement Of Cash Flows Prepared And Used

Cash Flow From Assets Definition And Formula Bookstime

Working Capital And Negative Working Capital Formula Is Defined With Examples It Measures The Differences Between What What Is Work Potential Growth Capitals

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-03-2c4a6ea86c4b4b13b8a440cee78fac7d.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)